Hello everyone, especially to the crypto community around the world, on this good opportunity I will introduce a Project that I think is very special, supported by a very brilliant idea idea, This project is CGCX.

In exchange for the first hybrid cryptocurrency on the market, Calfin Global Crypto Exchange -CGCX, offers an invaluable set of tools and features for institutional traders and investors. Our platform will allow investors to engage with the presale, which will begin on May 1st.

We seek to change the cryptocurrency market by offering the most reliable and secure investor platform to buy, sell, and use cryptocurrency. CGCX differentiates it by using other platforms - digital currency exchange, ICO logging platforms, merchant services, and smart contract platforms - all in one hopeful platform. With complete facilities on a single, secure, and easy platform, we can use cryptocurrency everyday devices around the world.

As part of its efforts to provide cryptocurrency needs, CGCX creates its own utility tokens. Known only as a CGCX Token, these coins can be freely exchanged through Ethereum. It can also be used for platforms in CGCX; users who can use big discounts by using them. By releasing tokens in presale with a 20% bonus, we can attract some early investors and build a strong foundation for further growth.

Vision

To be a global leader in crypto exchange and blockchain solutions, with a focus on financial benefit and safety of all stakeholders.

Mission

To offer the best quality service with a wide range of products by providing innovative, secure, & cost-effective solutions for customers, and expand to become a leading global blockchain solutions firm.

Calfin Global Crypto Exchange

Key Features

Our front-end interfaces will be user-friendly for both new and professional traders. Typical exchange functions will be presented with intuitive visual feedback that is common to other prevailing exchange platforms.

Our high-performance exchange platform is modular, lightweight and extendable. This ensures that we provide top-notch services for all our users while retaining our usability and productivity.

Protocol interoperability is another key feature of our platform. We have an experienced team of developers that is available to support, maintain, and improve the exchange platform to ensure that we are always adaptable to new protocols, features, improvements, and upgrades.

Buy and Sell: Fixed / Custom Amount (Retail Investor)

For ease of use, regular or first-time users have the option to buy or sell the number of pre-set digital currencies.

The number of blocks provides a known reference point and streamlines the buying / selling process. For example, a user may purchase Bitcoin in fractions of US $ 100, US $ 200, US $ 500, or US $ 1000, in accordance with prevailing market prices. Users can also send and request funds in a supported currency.

Deposit / Withdrawal

Deposits and withdrawals are handled via modals, or pop-ups. In the screenshot example below, the user is requested to deposit Bitcoin using Deposit Address, or by scanning QR code. By default, national currency deposits and withdrawals are made via wire transfers.

There will be an option to enable two-factor authentication ("2FA") for withdrawals and deposits. 2FA serves as an additional step in the process, adding a second security layer that will reassert the user's identity, making the storage / withdrawal process more resistant to attack and reducing the risk of fraud.

Key interactions in single point of entry

Execution is very simple; all users need to do is to click to trade. On top of that, real-time balances will update together with live market data. Order management, trade management, and quote management will all be displayed on one page.

Our trading platform features many order types and order attributes that are typically available in conventional exchanges. These are not available in most of the crypto exchanges and hence provide an edge to our exchange.

Available Order Types:

- Market - Buy or sell directly from the market. Trades are executed immediately.

- Limit - Buy or sell when a cryptocurrency reaches a specified price or better.

- Hidden - Covering up the entire order until a certain price.

- Partial Hidden - Covering up part of the order until a certain price.

- Stop Market - Close position once a certain price is reached.

- Stop Limit - Close position at a specified or better price once a certain price is reached.

- Reserve/Ice Berg - Allows you to submit large volume orders in increments while publicly displaying only a specified portion of the total order size. An iceberg order is a type of order placed on a public exchange. The total amount of the order is divided into a visible portion, which is reported to other market participants, and a hidden portion, which is not.

- Trailing Stop - An order to buy or sell a security if it moves in an unfavorable direction. Trailing stops automatically adjust to the current market price of the asset.

- Trailing Limit - Moves with the market price, and continually recalculates the stop trigger price at a fixed amount below the market price, based on the user-defined "trailing" amount.

- Time in Force (TIF) - The time in force for an order defines the length of time over which an order will continue working before it is canceled.

- Immediate or Cancel (IOC) - An IOC order allows a Trading Member to buy or sell a security as soon as the order is released into the market, failing which, the order will be removed from the market. A partial match is possible for the order, and the unmatched portion of the order is cancelled immediately.

- Good Till Cancelled (GTC) - A GTC order can be placed by an investor to buy or sell a security at a specified price that remains active until it is either rescinded by the investor or the trade is executed. GTC orders offer an alternative to placing a sequence of day orders, which expire at the end of each trading day.

- Fill or Kill (FOK) / All or None (AON) - The difference between AON orders and FOK / IOC orders is that, unlike FOK / IOC orders, AON orders will not be cancelled if it cannot be filled immediately and can be used in addition to Day Orders or GTC orders.

- Good Till Time (GTT) - The Buy or Sell Order will be cancelled if not executed until the specified Good Till Time.

- Display Quantity (Hidden Order) - The hidden order option ensures an order does not appear in the order book and only available for yourself. Hence, it does not influence other market participants.

- Executable Quantity - The exact quantity that is to be transacted after placing the order.

The general architecture of the CGCX exchange module can be separated into four sections: the gateways, the order management system, the asset manager, and the matching engine. Gateways serve to provide inputs into the system, and are used by traders, liquidity providers, and market makers to submit data to be processed in the order management system (“OMS”) and the matching engine. At CGCX, we have developed a high-performance system capable of handling over one million transactions per second. This engine powers the capabilities that handle the transaction processing, matching, and resolution of the inputs that are handed over from the gateways. To protect the data integrity and the security of the funds, we also have an asset management system that runs real-time checks on the balances and positions of every single account in the system to ensure that any errors and mismatches are caught immediately.

Exchange with Liquid Orderbooks

One of the problems faced by crypto community is the low liquidity of the trading pairs. These pairs trade with large spreads and an unresponsive price mechanism, which is detrimental to traders. To have a vibrant, liquid market, we employ automated market-making systems that ensure entry and exit for investors at all times.

A fully-populated, live and dynamic order book will be readily available across digital asset markets from day one of operation. Our exchange offers increased liquidity with better depth, leading to lesser price impacts. Partnerships are in the pipeline with leading exchanges that will help increase synergy for the benefit of the community as a whole

ICO Listing Platform

The CGCX hybrid platform not only allows our clients to trade with confidence in all cryptos, but also allows new alternate coin (altcoin) token issuers to list their tokens for trading.

New tokens can be listed in our pool for voting. The CGCX team will perform due diligence reviews of the tokens seeking listing. Upon approval, tokens will be listed for voting amongst the users of our platform. Based on the voting results, the tokens may be listed on the CGCX platform.

Users in the CGCX platform can use their CGCX Token(s) to vote for multiple tokens. We plan to use 50% of tokens received as voting fees for insurance costs to build further insurance protections.

Newly listed alternate tokens would further be monitored on an ongoing basis and could be delisted any time if they don’t maintain listing eligibility based on criteria set by CGCX.

CGCX Token Sale

We are launching our own CGCX Tokens, issued on the Ethereum blockchain using a Smart Contract.

It is a decentralized cryptocurrency issued on the basis of Ethereum and is standard ERC 20 token based on the Ethereum blockchain. The CGCX Token supports all Ethereum wallets and will be freely transferable on the Ethereum platform. We are offering a total quantity of 1 Billion CGCX tokens representing 50% of the total issuance volume of 2 Billion at a price of 1 ETH = 8500 CGCX Tokens.

Our platform, which is in advanced stages of testing, would be launched for beta live trading on June 1st, 2018 and exchange trading for general public would be launched on July 1st, 2018.

The proceeds of the token sales are mainly used for the enhancement of our hybrid platform, with further modules to offer additional blockchain solutions. The funds would also be used for the planned expansion into other regions as detailed in our roadmap.

Utility Tokens

CGCX tokens are utility tokens that form an integral part of CGCX ecosystem. Token value will reflect the degree of penetration and activity within the platform.

CGCX token is not a security token and does not indicate ownership of a company.

CGCX tokens will not pay dividends and CGCX Token holders will not earn any direct or indirect interest.

The more CGCX Tokens are being used within the CGCX ecosystem driving customer adoption, the greater the demand for CGCX Token.

As CGCX’s popularity grows and more users join the platform, new features will be released, which will further increase the interest among the CGCX Token holders.

CGCX Tokens can be used to pay the transactions fee for the trades executed in the exchange and earndiscounts on the transaction fee as per the table enclosed.

This discount is not available for others who do pay transaction fee with other currencies.

CGCX Tokens can be used to vote for preferred coins to be listed into our platform. It can be used in our Smart contract platform as well as in Merchant Solutions to avail discounted prices on products and services from a wide range of merchants. CGCX Tokens are only meant for such utility purposes and not meant to be used by buyers as an investment tool.

Vesting Plan For Founders & Team

After Year One 25%

After Year Two 25%

After Year Three 25%

After Year Four 25%

- Token Name: CGCX Token

- Token Symbol: CGX

- Token Type ; ERC20

- Max Supply of Tokens ; 2,000,000,000 CGX

- Token Sale Target ; 1,000,000,000 CGX

- 1 ETH ; 8500 CGX

- Soft Cap ; 5 Million USD

- Hard Cap in Token ; 1,000,000,000 CGX

- SAFT ; 47,600,000 CGX

- Pre-Sale & Main Sale ; 9,52,400,000 CGX

- Mode of payment ; ETH/BTC - Bank Wire Transfer

Token Allocation and Fund Allocation

The CGCX Wallet is the multi-currency payment gateway inside the CGCX ecosystem. It allows users to exchange fiat money, cryptocurrencies, or virtual goods for any liquid assets available on the platforms.

ROADMAP

In recent years, Singapore has become one of the top places for tech startups to conduct their businesses. Besides commanding a prime geographical location with easy access to growing tech markets in Southeast Asia, Singapore also enjoys strong government support that helps create a nurturing environment for startups to ride on latest technology trends.

We have chosen Singapore to be the Launchpad of the CGCX platform in the second quarter of 2018, capitalizing on its world class reputation as a stable financial hub and its connection to the global economy.

With funds raised through the token sales to public, we would expand our core services by enhancing our platform with additional modules. We would also venture into other regions to establish our global leadership in the blockchain solutions space. Our planned milestones are detailed in our roadmap diagram shown on the next page.

KYC/AML

At CGCX, we take pride in our established measures of self-regulation, in the wake of the constantly evolving regulatory landscape of cryptocurrencies. We will check our KYC/AML compliance procedures for compliance with the requirements of Monetary Authority of Singapore and with laws of Singapore.

CGCX implements automated KYC/AML services from Identity Mind, a leading provider of KYC/AML blockchain solutions. All the clients and incoming transactions on CGCX are screened against known offenders databases across the globe. Only KYC/AML cleared prospects can become clients.

If any of the users’ wallets have previously been involved in any illegal activities, the transactions to and from such wallets would automatically be rejected. This advanced security feature ensures that CGCX customers can trade safely.

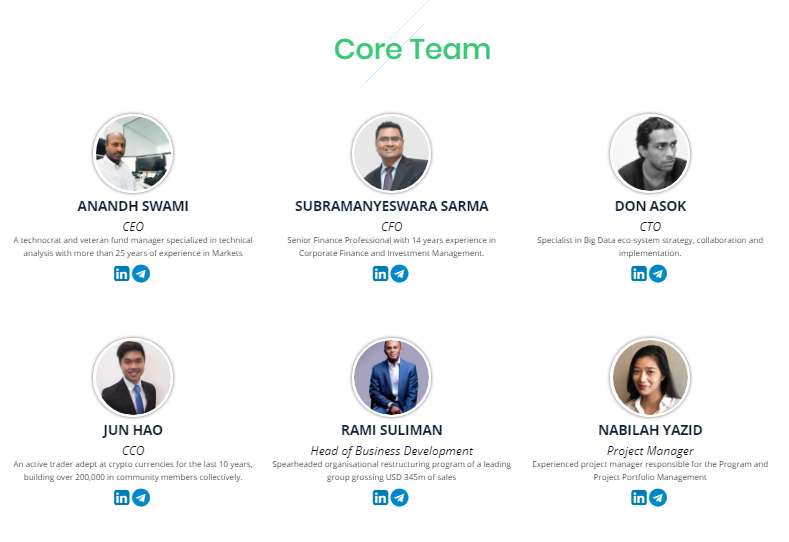

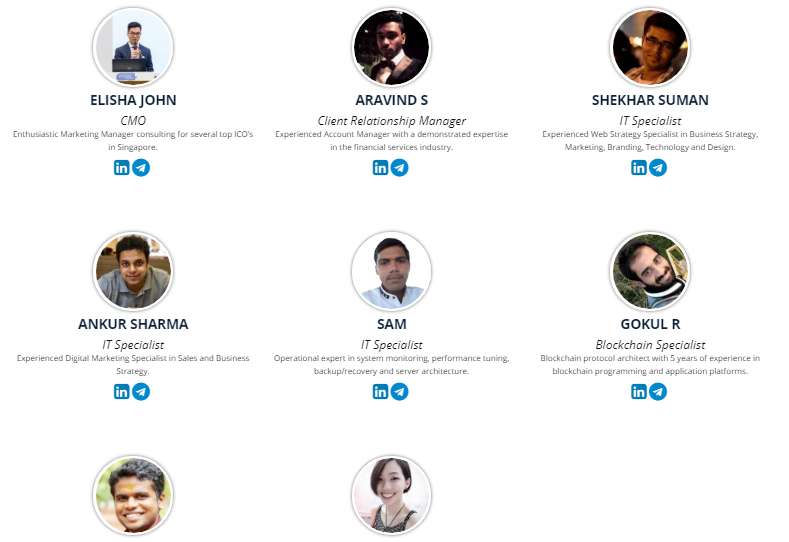

TEAM

- 10% - Vesting (Tim)

- 10% - Benih (Pendiri)

- 11% - Pemasaran

- 19% - Masa Depan (Produk R & D)

- 50% - Publik

- 5% - Business Development

- 15% - Team

- 20% - Working Capital

- 20% - Marketing

- 30% - Product (R&D)

The CGCX Wallet is the multi-currency payment gateway inside the CGCX ecosystem. It allows users to exchange fiat money, cryptocurrencies, or virtual goods for any liquid assets available on the platforms.

- Multi-asset compatibility (any blockchain asset compatible with and accepted by the CGCX Wallet).

- Best available foreign exchange rate and transaction fees.

- Decentralized and secure storage.

- Items are stored on a blockchain-based-system.

- Fraud and scams are prevented and belong to the past.

- This is insured against cyber attacks and hacking

ROADMAP

In recent years, Singapore has become one of the top places for tech startups to conduct their businesses. Besides commanding a prime geographical location with easy access to growing tech markets in Southeast Asia, Singapore also enjoys strong government support that helps create a nurturing environment for startups to ride on latest technology trends.

We have chosen Singapore to be the Launchpad of the CGCX platform in the second quarter of 2018, capitalizing on its world class reputation as a stable financial hub and its connection to the global economy.

With funds raised through the token sales to public, we would expand our core services by enhancing our platform with additional modules. We would also venture into other regions to establish our global leadership in the blockchain solutions space. Our planned milestones are detailed in our roadmap diagram shown on the next page.

KYC/AML

At CGCX, we take pride in our established measures of self-regulation, in the wake of the constantly evolving regulatory landscape of cryptocurrencies. We will check our KYC/AML compliance procedures for compliance with the requirements of Monetary Authority of Singapore and with laws of Singapore.

CGCX implements automated KYC/AML services from Identity Mind, a leading provider of KYC/AML blockchain solutions. All the clients and incoming transactions on CGCX are screened against known offenders databases across the globe. Only KYC/AML cleared prospects can become clients.

If any of the users’ wallets have previously been involved in any illegal activities, the transactions to and from such wallets would automatically be rejected. This advanced security feature ensures that CGCX customers can trade safely.

TEAM

If you know how to improve our community.

If you know how to spread information about us in this world.

If you have any ideas for other improvements, it is a privilege

If you all participate in our bounty.

PLEASE JOIN US, FOR MORE INFORMATION YOU CAN VISIT LINKS BELOW:

ANN ; https://bitcointalk.org/index.php?topic=3360185.new#new

LIGHTPAPER ; https://www.cgcx.io/wp-content/uploads/2018/04/23-april-2018-CGCX-Lightpaper-new.pdf

WEBSITE ; https://www.cgcx.io/

FACEBOOK ; https://www.facebook.com/CGCXofficial/

TWITTER ; https://twitter.com/CGCXofficial

TELEGRAM ; https://t.me/cgcxofficial

LINKEDIN ; https://www.linkedin.com/company/cgcx/

Bitcointalk profile URL ; https://bitcointalk.org/index.php?action=profile;u=2109527

ETH address ; 0x7E70C5E5A01D1409f71eC1c278d29f545DEd5c71

Tidak ada komentar:

Posting Komentar